In this life full of uncertainties, it is essential to have a few things in check. One thing you can have is life insurance. A life insurance policy takes away the worry of leaving your dependents and kin with a financial burden in case of your sudden death. Once you start making a living, have it on top of the list of things you would not do without. Before purchasing a policy, there are a few things you need to consider. They include:

(TOP 5) Best Things to Consider When Buying a Life Insurance Policy

1. Type of Policy

There are many policies floated in the insurance market today. Get the most appropriate policy that fits your budget. There are term life policies that cover you for a specific period. Once the time elapses, the coverage does too.

On the other hand, whole-life policies guarantee lifetime coverage with a cash-back guarantee. A universal plan provides death benefits and investing options to its holders. You can seek the services of a professional lawyer for life insurance policy for advice on the best policy for you since all this can be quite confusing.

2. Policy Underwriting Considerations

Most insurers offer life insurance policies depending on the health and personal activities of the policyholder. Those with perfect health qualify for preferred or super-preferred rates. These terms, if assumed by an applicant in a poor health state, can be termed as insurance fraud and might not be paid out. Not all insurances have such terms. Shop around for one that fits your lifestyle. It would help to consider other inclusions and exclusions in your policy. These terms should be favourable to you to ensure that you get exactly what you are looking for.

3. Premiums

The cost of premiums for each policy and insurer differ. This is important as failure to pay premiums to discontinue the policy and payout might not be made. The premium payment also varies from one policy insurer to the other. Some offer fixed premiums throughout, while others offer them on a stepped basis. Premiums on a stepped policy increase as you grow.

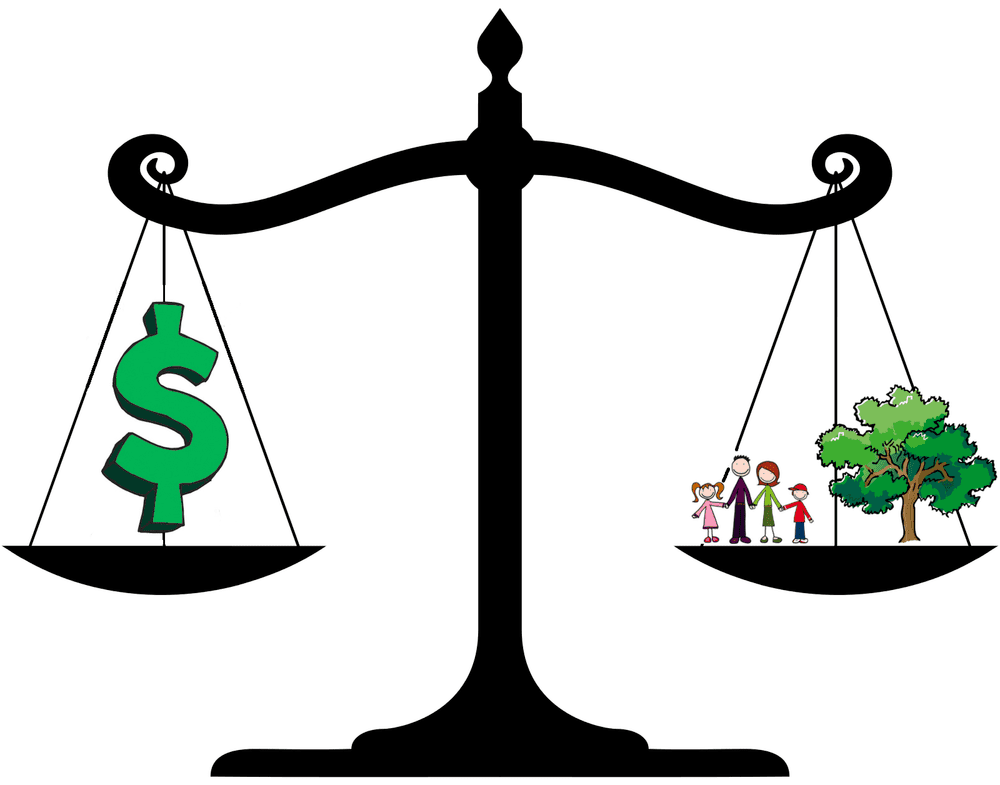

4. Benefits Vs. Costs

Before taking up a policy, compare the benefits you or your beneficiaries ought to receive and the costs you might incur. The comparison helps determine the policy to take and the one with the highest payout terms. Some policies pay out a percentage of the amount in case it matures before you die or a lump sum with interest in case you complete the tenure. You can compare different insurers’ policies and get the most beneficial to you.

5. Benefits Payout

Each policy has a maturity date. The date can be after the set period expires or after your demise. Once a policy matures, you should consider the terms of the payout. Some policies pay a lump sum amount while others pay as premiums for a specific period. Others make a lifetime payout to beneficiaries until they become adults. Additionally, consider the duration each insurer takes before making the payouts. Some might take a few weeks, while others take months.

Finding the social psychology coursework writing services and Social Psychology Writing Services is not easy unless one is keen to establish a reputable social psychology assignment writing service provider & social psychology research writing services.

Custom case study writing services are not hard to come across for those in need of Case Study Writing Help and online case study assignment writing services.